Pedro A.

See all reviews

Blend credit risk modeling skills with Python programming: Learn how to estimate a bank’s loan portfolio's expected loss

Skill level:

Duration:

CPE credits:

Accredited

Bringing real-world expertise from leading global companies

Doctorate (PhD), Economics & Business Administration

Description

Curriculum

Free lessons

1.1 What does the course cover

5 min

1.2 What is credit risk and why is it important?

5 min

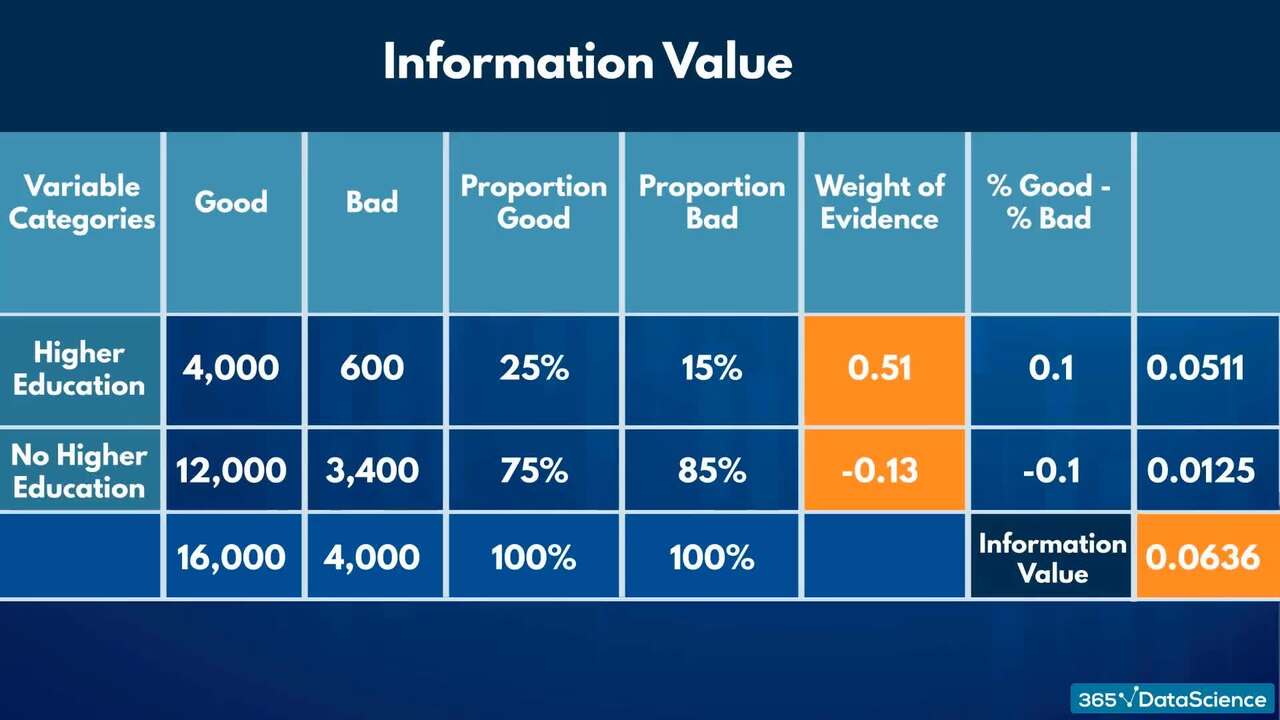

1.3 Expected loss (EL) and its components: PD, LGD and EAD

4 min

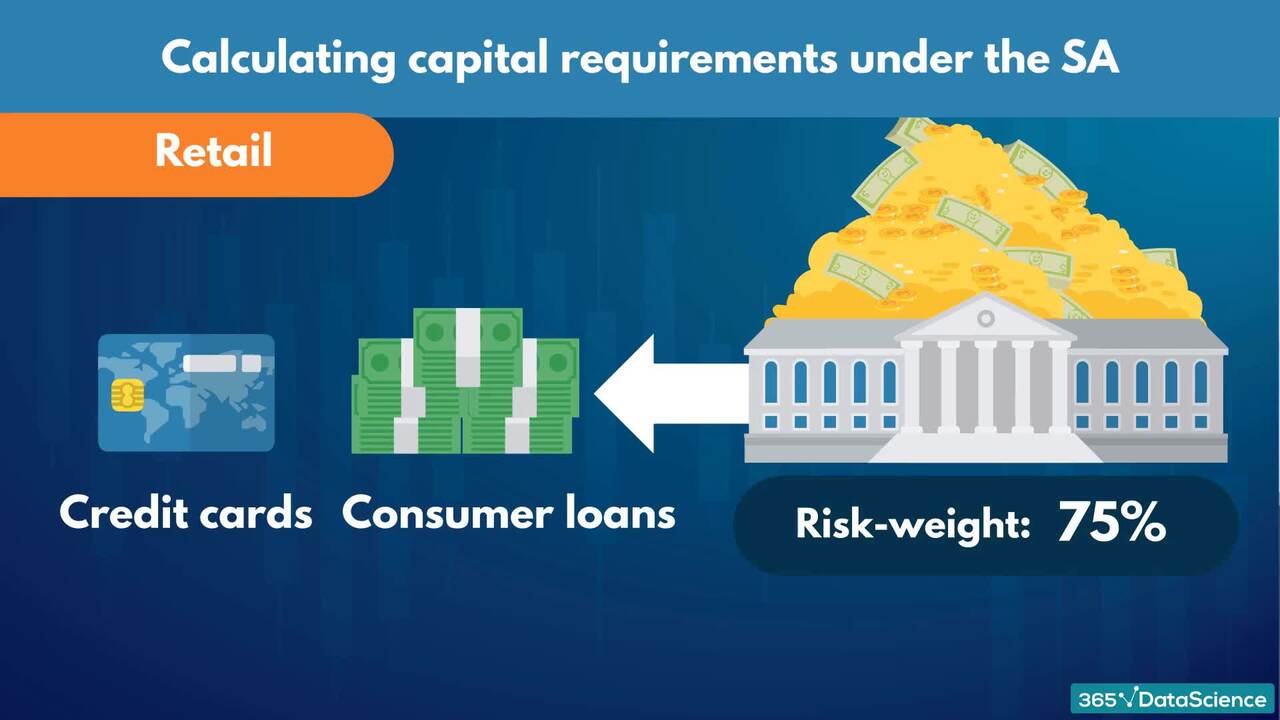

1.4 Capital adequacy, regulations, and the Basel II accord

5 min

1.5 Basel II approaches: SA, F-IRB, and A-IRB

10 min

1.6 Different facility types (asset classes) and credit risk modeling approaches

9 min

94%

of AI and data science graduates

successfully change

96%

of our students recommend

$29,000

average salary increase

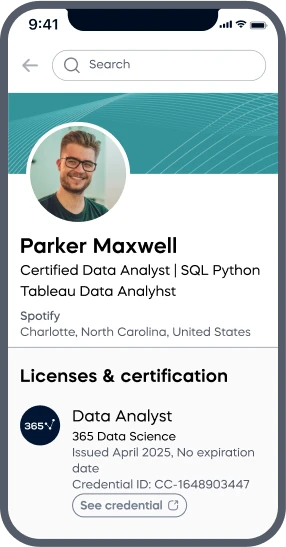

ACCREDITED certificates

Craft a resume and LinkedIn profile you’re proud of—featuring certificates recognized by leading global

institutions.

Earn CPE-accredited credentials that showcase your dedication, growth, and essential skills—the qualities

employers value most.

Certificates are included with the Self-study learning plan.

How it WORKS