Ahmed H.

See all reviews

Blend investment analysis skills with Python programming: Master financial analysis using Python

Skill level:

Duration:

CPE credits:

Accredited

Bringing real-world expertise from leading global companies

Master's degree, Economic and Social Sciences

Bringing real-world expertise from leading global companies

Master's degree, Finance

Description

Curriculum

Free lessons

1.1 Course Introduction

4 min

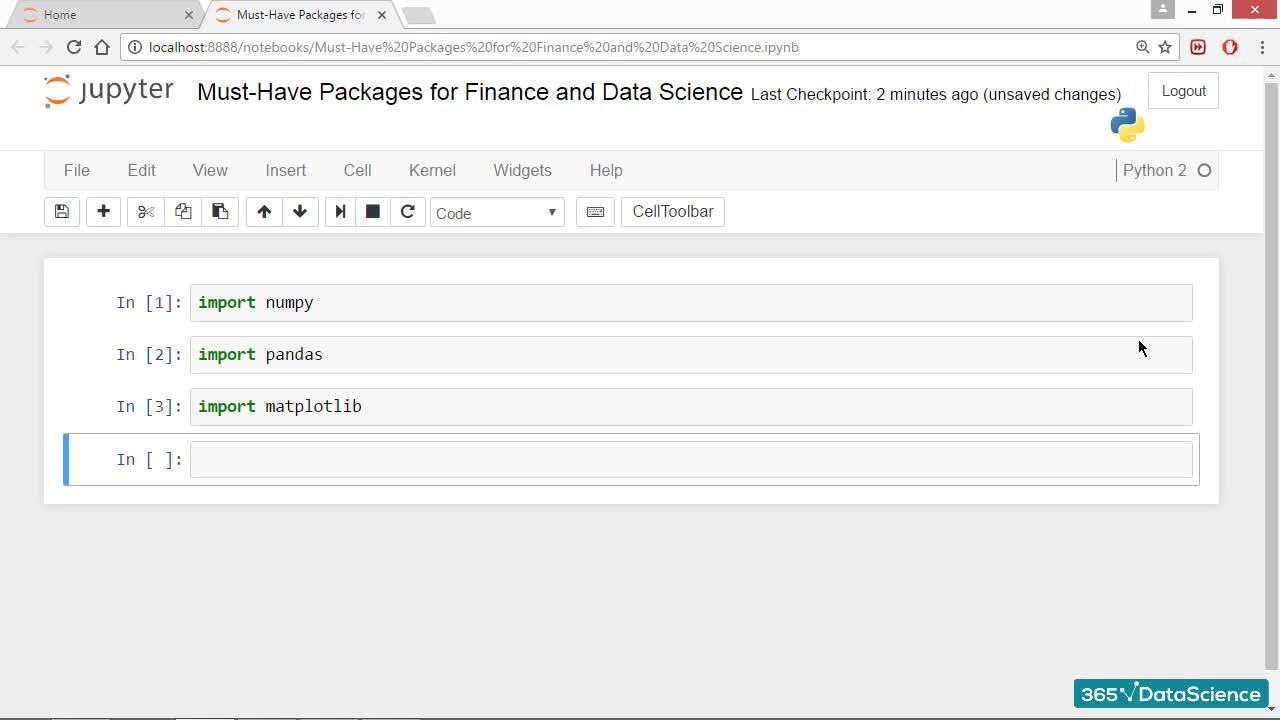

1.2 Must-Have Packages for Finance and Data Science

5 min

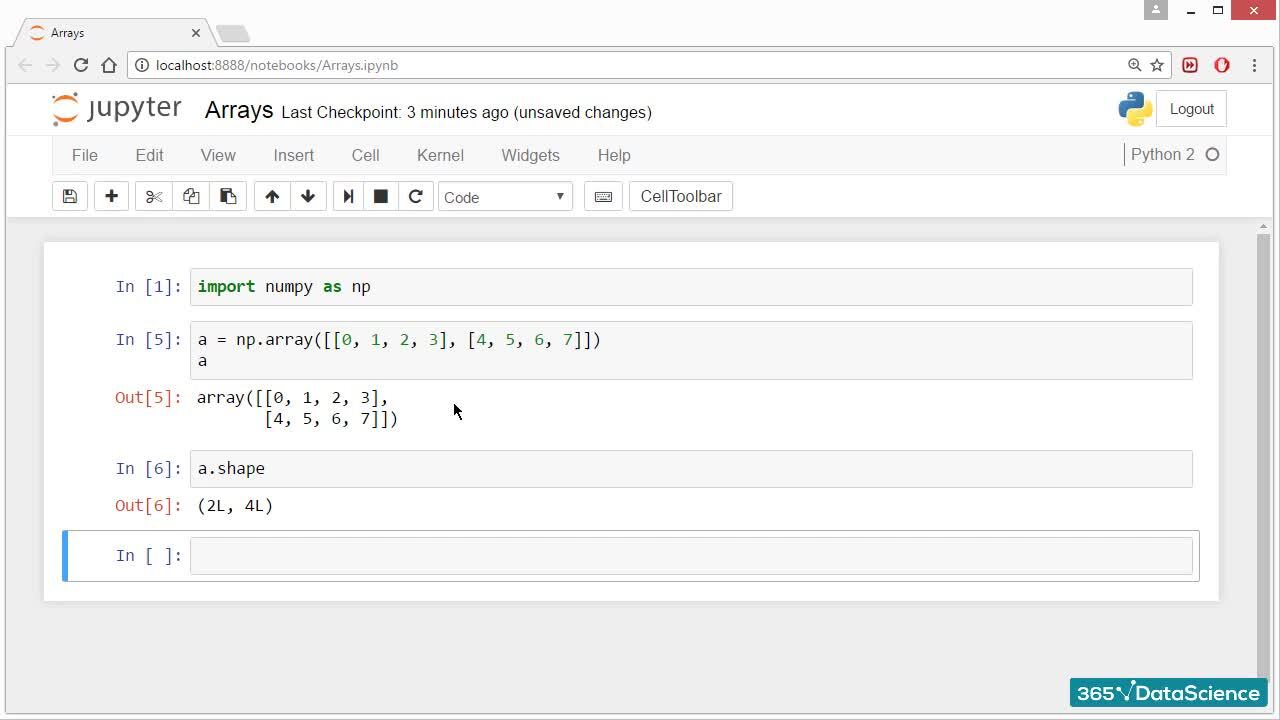

1.3 Working with Arrays

6 min

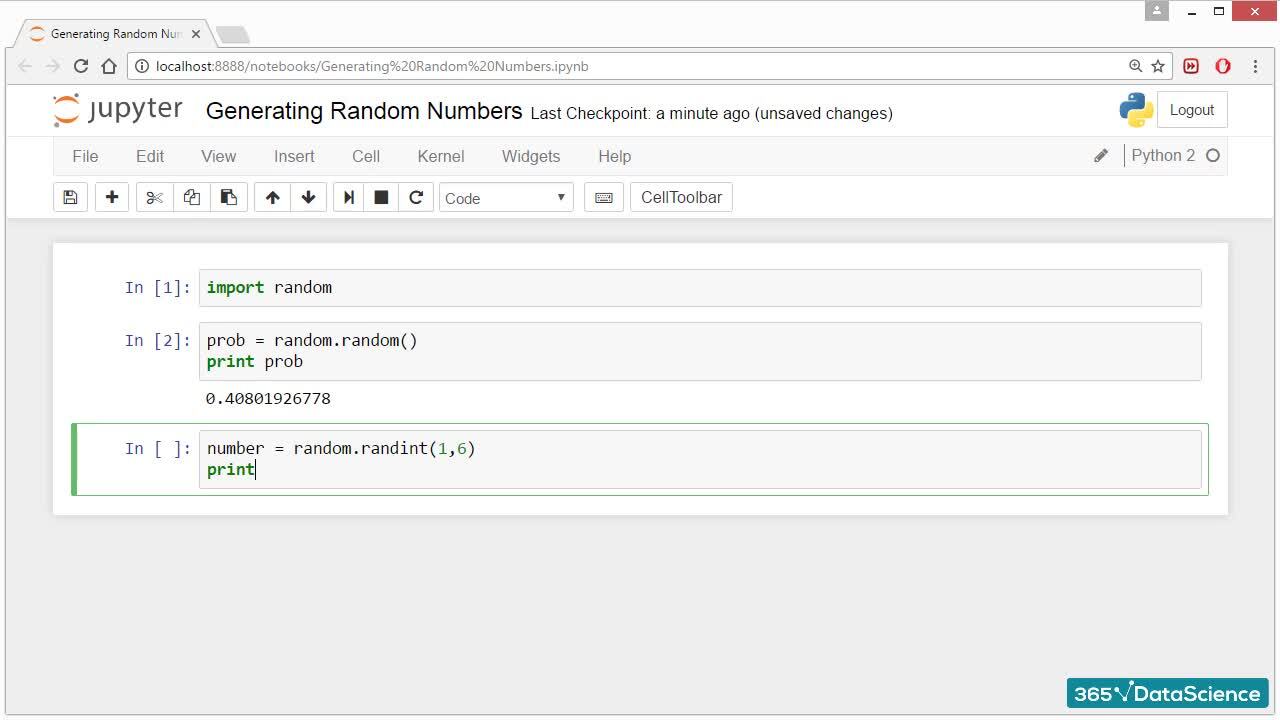

1.4 Generating Random Numbers

3 min

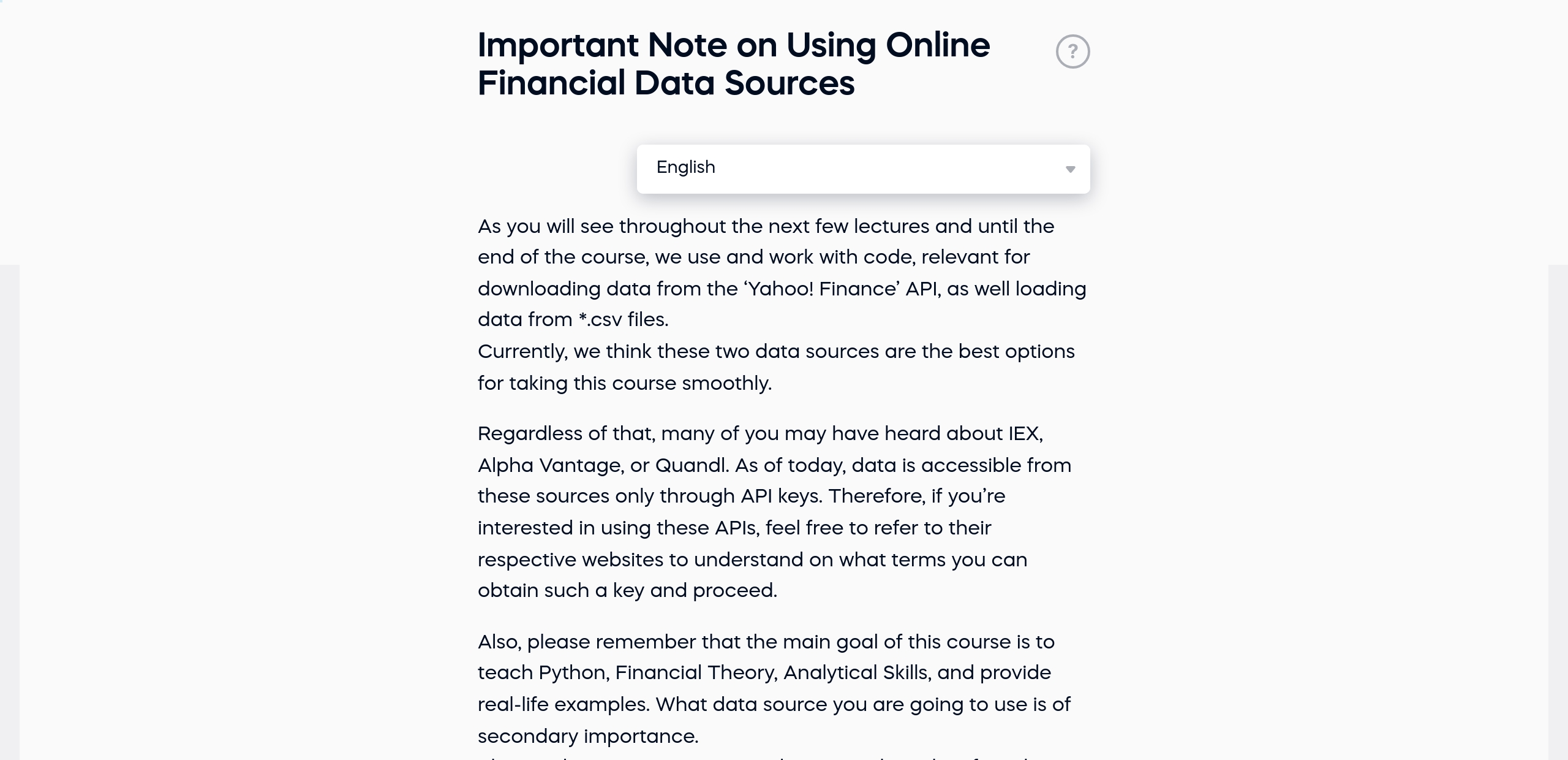

1.5 Important Note on Using Online Financial Data Sources

1 min

1.6 Using Financial Data in Python

3 min

96%

of our students recommend

9 in 10

people walk away career-ready

$29,000

average salary increase

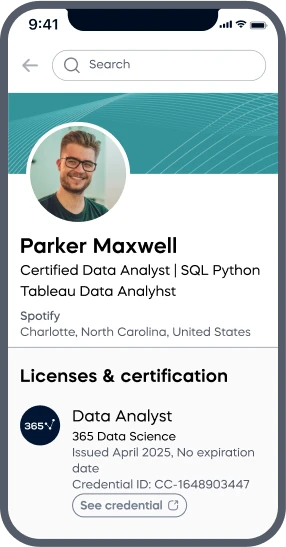

ACCREDITED certificates

Craft a resume and LinkedIn profile you’re proud of—featuring certificates recognized by leading global

institutions.

Earn CPE-accredited credentials that showcase your dedication, growth, and essential skills—the qualities

employers value most.

Certificates are included with the Self-study learning plan.

How it WORKS