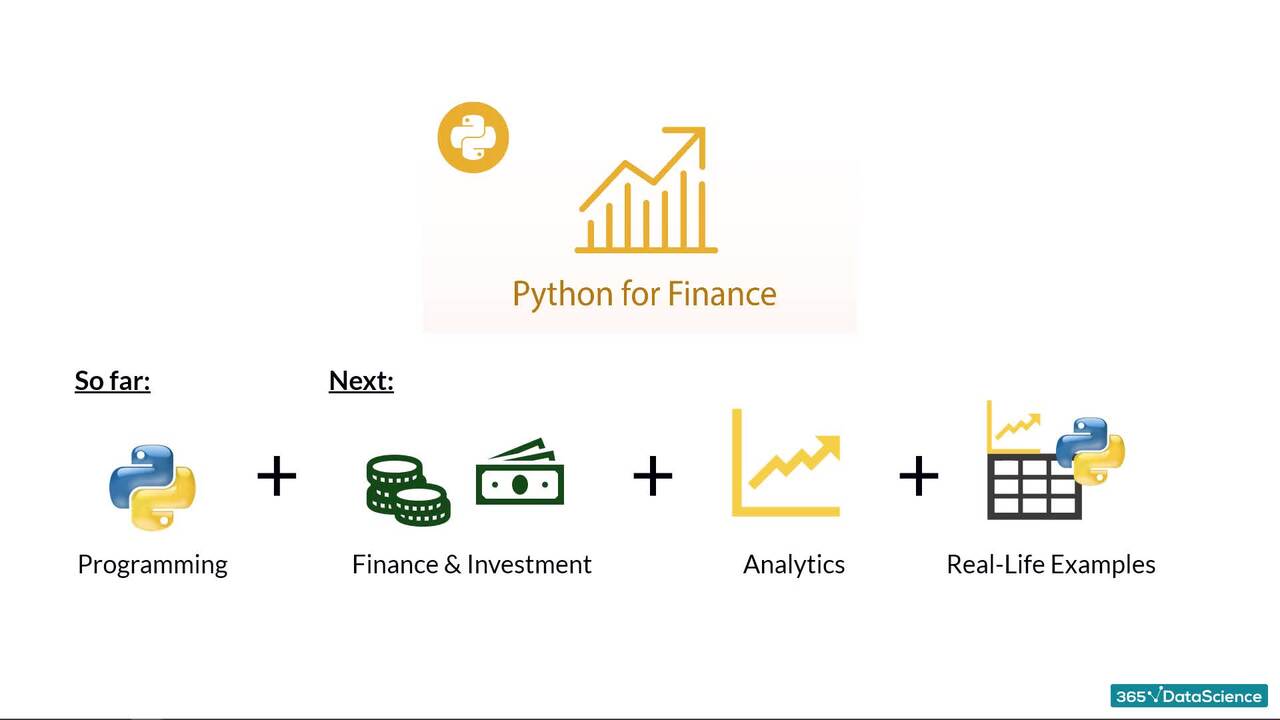

Python for Finance

Blend investment analysis skills with Python programming: Master financial analysis using Python

Start for Free

Start for Free

What you get:

- 6 hours of content

- 27 Interactive exercises

- 224 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Python for Finance

Start for Free

Start for Free

What you get:

- 6 hours of content

- 27 Interactive exercises

- 224 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 6 hours of content

- 27 Interactive exercises

- 224 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Obtain the efficient frontier in Python, visualizing the best possible investment portfolios

- Calculate and compare the rates of return (and the associated risk) of various securities in Python, allowing you to make informed decisions

- Measure portfolio investment risk by calculating a portfolio’s risk, its correlation with other assets, and distinguishing between idiosyncratic and market risk

- Apply Markowitz Optimization in Python to construct optimal investment portfolios

- Leverage the Capital Asset Pricing Model (CAPM) to calculate the expected portfolio return of real data in Python

- Run a Monte Carlo simulation in Python to visualize the potential outcomes of financial investments and estimate the associated risk

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 Course Introduction

4 min

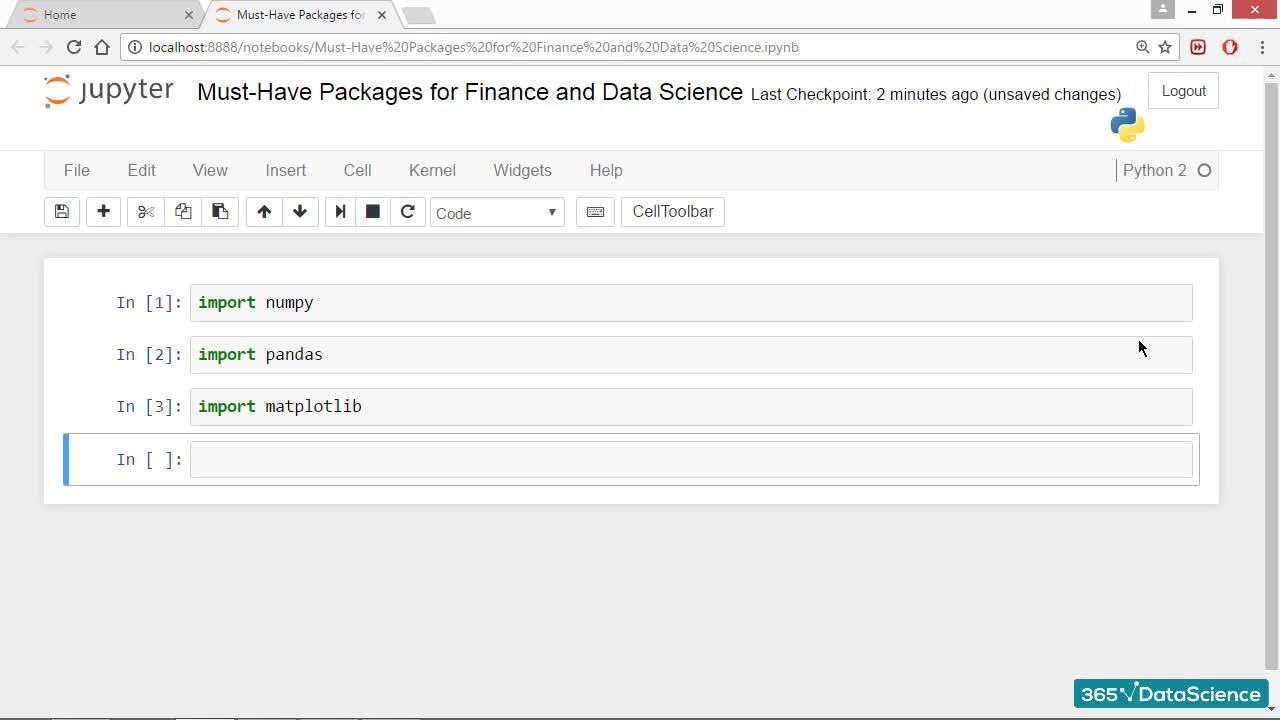

1.2 Must-Have Packages for Finance and Data Science

5 min

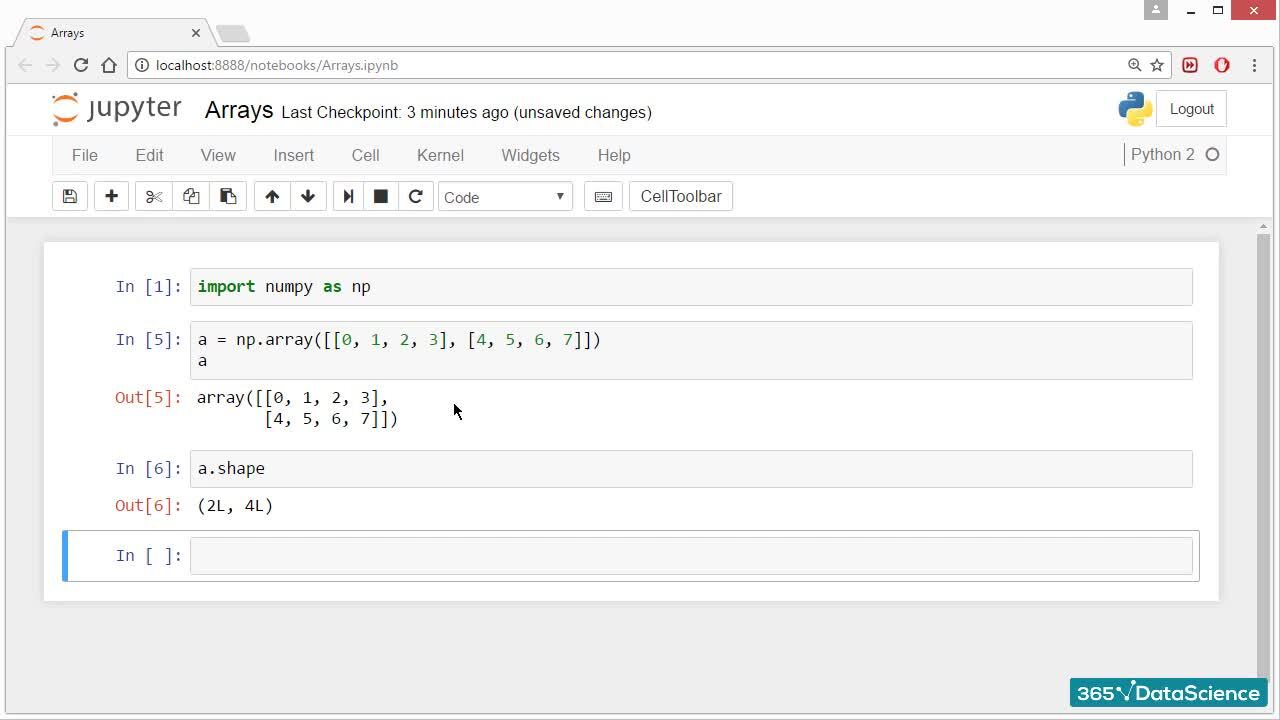

1.3 Working with Arrays

6 min

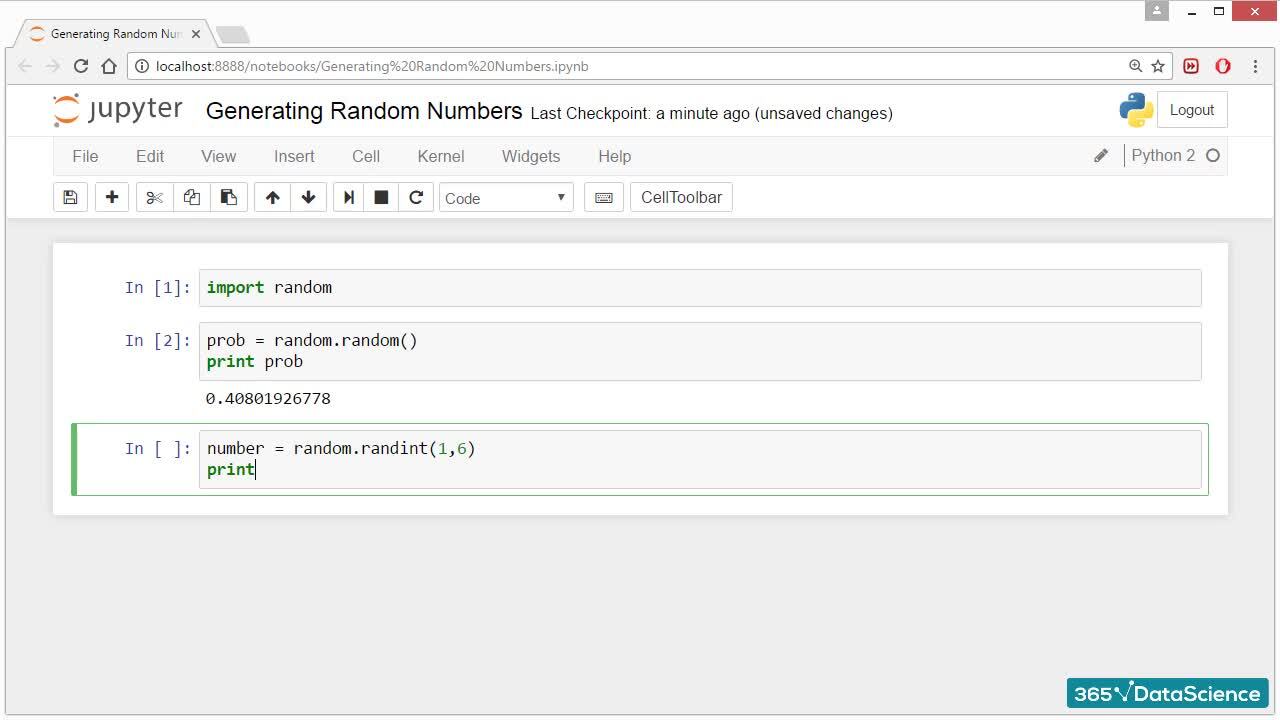

1.4 Generating Random Numbers

3 min

1.5 Important Note on Using Online Financial Data Sources

1 min

1.6 Using Financial Data in Python

3 min

Curriculum

Topics

Course Requirements

- You need to complete an introduction to Python before taking this course

- Basic skills in statistics are required

- You will need to install the Anaconda package, which includes Jupyter Notebook

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring investment analysts, financial analysts, data analysts, data scientists

- Current investment analysts, financial analysts, data analysts, data scientists who are passionate about acquiring domain-specific knowledge in investment analysis

Exams and Certification

A 365 Data Science Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Martin began working with 365 in 2016 as the company’s second employee. Martin’s resilience, hard-working attitude, attention to detail, and excellent teaching style played an instrumental role in 365’s early days. He authored some of the firm’s most successful courses. And besides teaching, Martin dreams about becoming an actor. In September 2021, he enrolled in an acting school in Paris, France.

What Our Learners Say

365 Data Science Is Featured at

Our top-rated courses are trusted by business worldwide.