Business analysts always look for data that provides them with valuable insights. Historical analysis, in particular, deals with sorting through past data to answer what happened, so then management can figure out how the business can benefit from it.

Essentially, they are looking for trends. And not in the way Pokémon GO swept the nations in waves of mainstream popularity – though that was certainly quite cool. What we mean is finding patterns in data or, otherwise said, what the data they’re analyzing has in common. This allows a company to evaluate business performance, come up with better business intelligence techniques, and take corrective actions when necessary.

In this article, we’ll introduce you to an easy-to-use, yet impressive, results-yielding technique that analysts implement during the descriptive phase – trend analysis.

What Is Trend Analysis?

We’ll start by answering what exactly trend analysis is. By now, we know that it is the practice of finding patterns in your data. But, of course, there’s more to it than that.

In most organizations, trend analysis – also known as technical analysis – is used to monitor metrics and their development over time. As such, the technique relies on effective historical analysis.

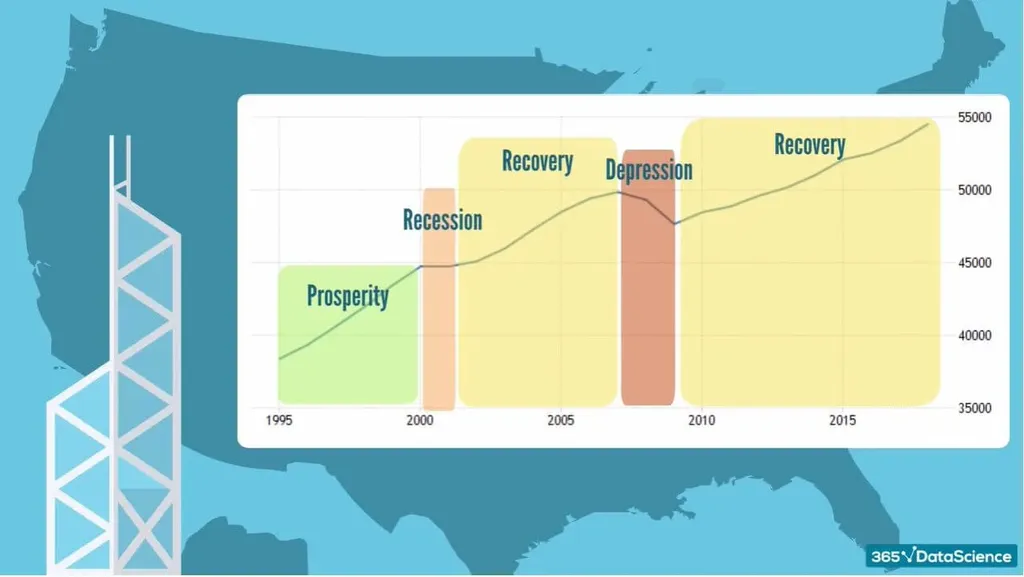

If you were to go back in history and consider a country’s economic development, you will notice stages of:

- Prosperity

- Recession

- Depression

- Recovery

The same development applies to companies as well. And, based on this historical analysis, stakeholders can make an estimation about the future of their business.

What Are Trend Analysis Factors?

If we look at Apple’s revenues for the past 5 years, we’ll see the following chart:

This trajectory can give us an idea about the possible development of future sales, right?

Managers and their teams use trend analysis with a focus on the factors that can impact their business. In some situations, these factors are within their control, while in others – they aren’t. High-performing organizations focus trend analysis on both internal and external factors.

Internal Factors

Typically, an internal factor can be influenced. What we mean by this is the variables that can be shaped by management’s decisions. For example, internal factors can be:

- The allocation of manpower, capital, and bonuses

- The selection of targets and business plans

External Factors

External factors, on the other hand, impact the ability of a business to achieve its strategic goals and objectives. Common external factors which often underpin trend analysis include:

- Competitors

- Legislation

- Economic environments

- Political environments

What’s important to note is that, even though a company can’t really influence the development of these factors, it still needs to study them. Why is that? Well, simply because it allows them to make important decisions and have insight on what could be coming next.

Think of a situation when the management can predict sales movements and see they are about to decline because the country of operation is likely to go into a recession. The company can’t prevent that outcome, but what they can do is plan accordingly. Stopping large capital expenditure projects and focusing on cash flows and efficiencies – these are some of the pre-emptive preparations that management has to make in this scenario.

What Are the Most Common Types of Trend Analysis?

Trend analysis can take many forms. Here, we will focus on three of the most common use cases that managers and their teams encounter:

- Performance management

- Project management

- Trading analysis

We’ll go further into detail about what each type is and how a company might use it to benefit their business.

Trend Analysis in Performance Management

Generally, any manager and their team can use trend analysis in their performance management. In this context, we use this type of analysis to monitor, prevent, or remedy aspects of business operations that could potentially harm performance.

Let’s look at an example of performance management through trend analysis. Suppose that a person in your organization needs to deliver the same report at a specific time every day. But then you look at the times this person delivers the report and find that they are always late – the trend here is consistently missing the report deadline. So, based on our analysis, we expect this pattern of decreased employee efficiency will continue.

Surely, the recipients of this report will not be happy. Thus, we need to find the reason why the person is always late. This is called performance management: monitoring someone’s performance, remedying it if it’s not up to par with management’s expectations.

How can we fix the issue? We can apply many tools to understand the root cause. The one we will discuss here considers the different types of waste – a key element in Lean methods. Essentially, we’ll ask the person preparing the report some questions to understand what is happening and why they are late:

- Is the process well-documented?

- Have they been well-trained? Do they know how to refresh the report?

- Do they have a clear idea about the report’s requirements and deadline?

- Do they have all the information they need in order to update the report on time or do they have to wait for someone to give it to them?

- Is there someone that can potentially help them deliver the report faster?

- Do they see any opportunities to optimize the process, to make it shorter and more efficient?

These questions will help us understand if there is any waste in the process. This way we consider the performance trend and used some performance management tools to remedy the process.

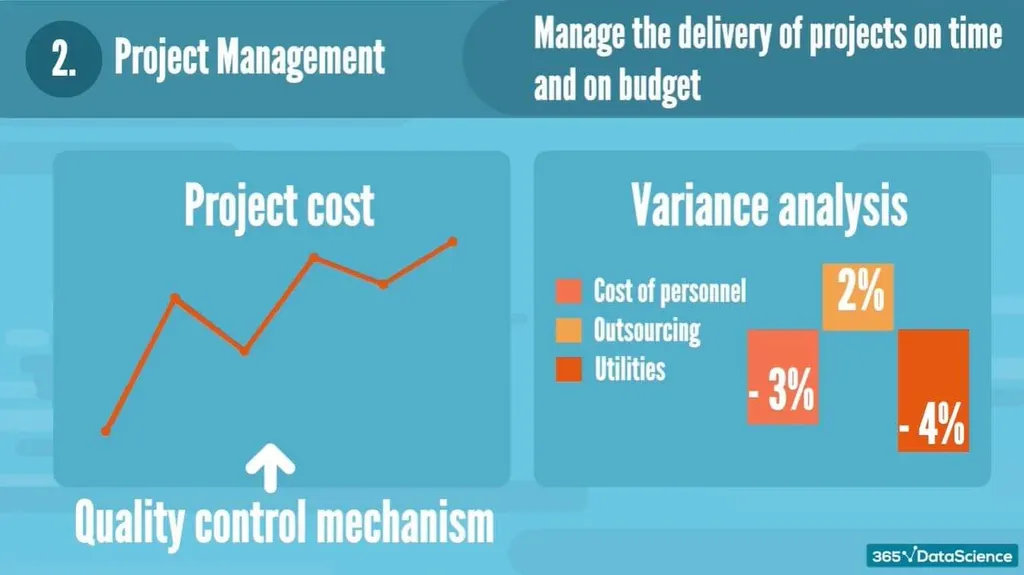

Trend Analysis in Project Management

Trend analysis in project management is best suited for managing personnel who is not engaged in an ongoing delivery process. This involves tracking variances in cost and schedule performance. We use this type of analysis as a quality control mechanism to anticipate and better manage employees delivering their projects on time and within budget.

Every project starts with a business case, a cost projection, and the projected benefits that the project will provide throughout its lifetime. Meanwhile, trend analysis allows us to monitor how our performance versus the project costs and benefits planned initially, as well as how we are doing in terms of timing.

Trend Analysis in Trading

The third type of trend analysis is used in trading. We apply the technique to study price and volume movement as a means of us anticipating spikes or dips of traded securities. This kind of trading analysis is relevant for finance professionals whose job involves trading stocks, commodities, or currencies.

An important thing to note here is that this is a highly speculative technique and by far not an exact science.

Companies typically hedge their commodity exposure to mitigate potential financial risks, not relying on technical analysis extensively. Examples of frequently traded and hedged commodities are:

- Oil

- Steel

- Aluminum

- Sugar

- Copper

Many businesses need these commodities for their production process. And some hedging strategies are based on trend analysis in the sense that finding patterns in commodity price movements allows companies to gain an idea of how the price is likely to evolve over time.

Based on that, they can define their strategies.

Trend Analysis: Next Steps

As you can see, trend analysis can play a significant role in the future of a business. Based on historical analysis, this technique looks for patterns and highlights issues that might be holding a company back.

Should you embark on the journey towards becoming a business analyst, you’ll be be advising companies on their problem areas, as well as presenting ways to fix them. Moreover, you’ll be a vital part of the business performance optimization and stimulate growth within the company. Doesn’t that sound like the ultimate career goal?