Data science is a multidisciplinary field, so not only does it require good coding skills and an analytical mindset but it also domain expertise. And since it has become an integral part to success in nearly every industry, professionals should have expertise in the field they work in. For example, those working with data science in insurance must be aware of the terminology, have a firm grasp of all the basics, and keep updated with all new developments.

In this article, we’ll touch upon the concept of insurance, as well as its types and benefits. Then, we’ll explore what data people in the insurance industry work with day to day. Next, we’ll see what skills you need to apply for data science in the insurance industry and the responsibilities you might be charged with once you land the job. Finally, we’ll discover the most common use cases that will probably get you interested to begin your first step.

Table of Contents

- Introduction to Insurance

- What Types of Data in Insurance Are There?

- What Are the Applications of Data Science in Insurance?

- What Is the Role of a Data Scientist in Insurance?

- What Are the Required Skills to Become a Data Scientist in Insurance?

- Useful Resources

- How to Become a Data Scientist in Insurance: Next Steps

Introduction to Insurance

We can define the concept of insurance in many ways. The simplest definition would be:

A mutual agreement between two parties, the insurance company or institution, often called the insurer, and the individual or business, known as the insured. An insurance policy is used to cover any financial loss one might experience because of sudden emergencies.

Of course, such contingencies can cause both emotional and financial loss, but only the latter can be compensated with money since insurance can be considered as a risk management technique where the insured pays a certain amount to the insurer, called a “premium”. Individuals can use this policy to protect anything whether it's their health, their lives, or even their cars.

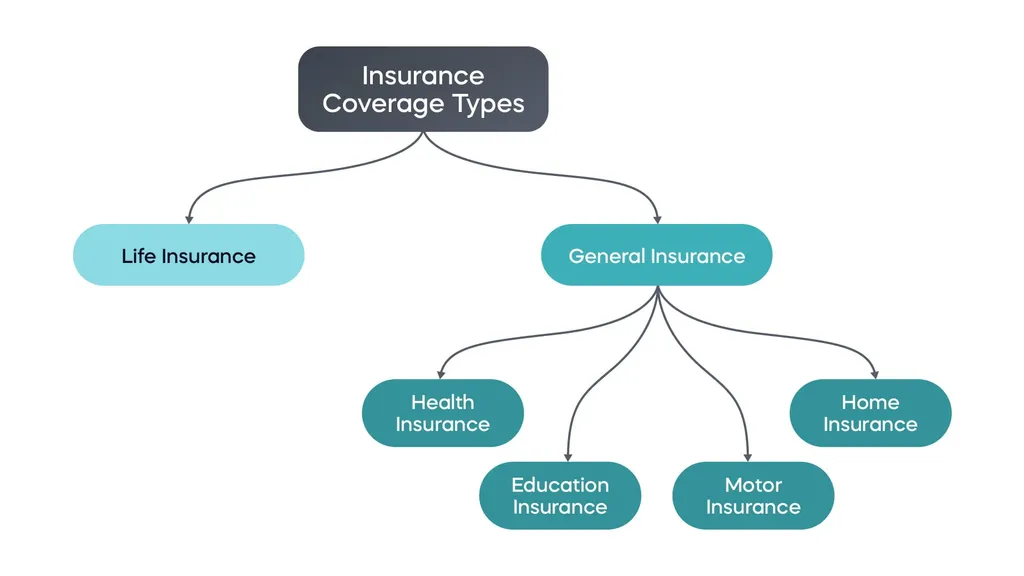

Types of Insurance Coverage

There’re mainly two types of insurance coverage:

- Life insurance

- General insurance

Life Insurance

This type of policy is usually used by people with dependents where the insured pays a certain amount of money to the insurance company to be returned to the insured’s family in the event of sudden death.

General Insurance

This policy is further categorized into other types of insurance such as:

- Health Insurance. Since healthcare is one of the most expensive life services in most countries, it’s essential to ensure financial protection in case of any health-related conditions.

- Home Insurance. This is to compensate for any losses in one’s residence whether they’re a result of man-made accidents or natural disasters like earthquakes, floods, and hurricanes.

- Education Insurance. While not very common, it’s used mainly by parents for their children’s education. When the child reaches a certain age (usually 18), either they or the parent can take the money and invest it in higher education.

- Motor Insurance. As a vehicle owner, you can use the motor policy to compensate for any damage caused by road accidents. It’s important that you keep the insurance papers with you in the car all the time.

Benefits of Insurance

With all we discussed so far, you must’ve realized how important it is to have insurance coverage. We can probably summarize some of the benefits in the following points:

- It provides financial protection and safety.

- It contributes to a country’s economic growth.

- It helps ensure risk sharing and distribution.

- It qualifies the insurer for tax deduction according to their plan.

- It provides pension plans so that people can ensure a monthly income when they grow up.

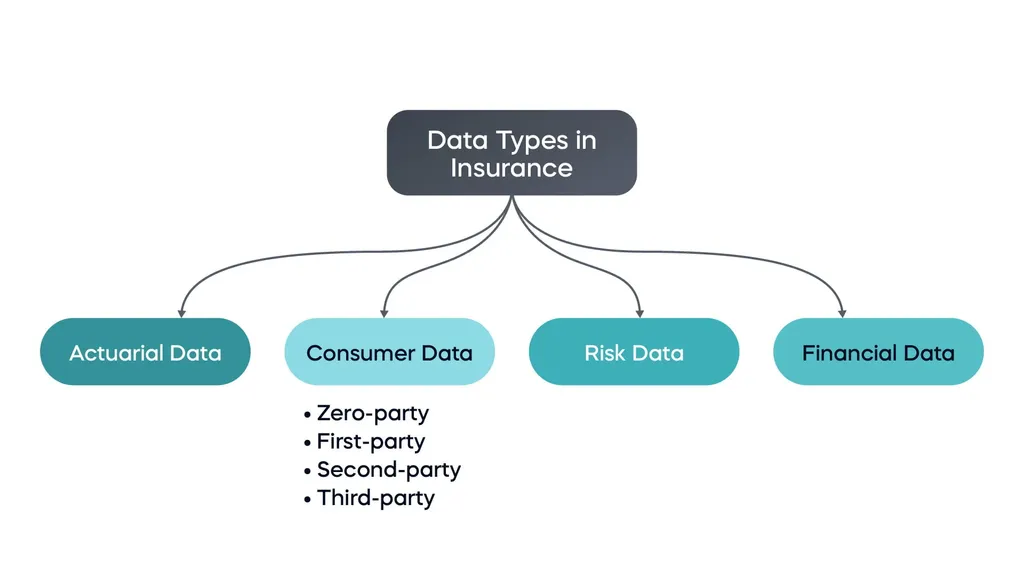

What Types of Data in Insurance Are There?

As the world’s population rises, you can imagine how much data is generated every day in the insurance industry. Unfortunately, a lot of it goes to waste at a time when leveraging its power can dramatically promote growth in all aspects. Insurance data analytics software development becomes crucial as we navigate the diverse data types, including actuarial, risk, financial, and consumer data. Discovering the applications of data science in insurance, we explore how it aids in fraud detection, personalized services, risk assessment, and more. Aspiring data scientists in the insurance sector must equip themselves with domain knowledge, programming language fluency, and skills to contribute effectively to the field's dynamic landscape.

There are different data types involved in the daily processes and transactions between insurers, insured individuals, and many other parties, the main ones being:

- Actuarial data

- Risk data

- Financial data

- Consumer data

We can further categorize consumer data into 4 different types:

- Zero-party data comes directly from consumers and can be collected using polls and surveys about their needs and preferences.

- First-party data, collected from e-mails, web visits, and more, concerns itself with consumers’ activity.

- Second-party data is also consumers’ data but collected by a third, external company. Marketing specialists can use this data to improve customer experience and develop partnerships.

- Third-party data, which insurance companies can attain from third-party providers that collect data about consumers from a variety of sources. Combining this external source with the other 3 types of consumer data makes the perfect combination for creating detailed customer profiles.

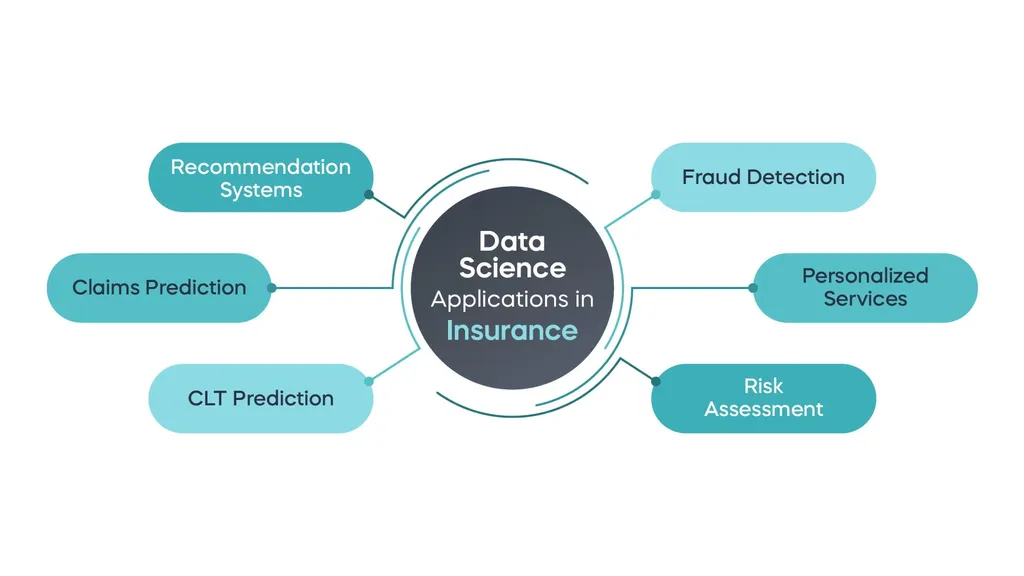

What Are the Applications of Data Science in Insurance?

From fraud detection to predicting lifetime value, using data science techniques has helped insurance companies reduce costs and provide better services. These are the most known applied use cases of data science in insurance:

- Preventing financial losses by detecting fraudulent activity using predictive modeling techniques.

- Personalizing services and policy offers with advanced analytics to extract valuable insights about customers.

- Using the matrix model to define and assess financial risks.

- Predicting customer lifetime value by analyzing customer behavior data.

- Predicting future claims using models like logistic regression and random forests.

- Building recommendation engines using special filtering systems to recommend the most relevant products to the customers.

What Is the Role of a Data Scientist in Insurance?

A proficient team of data professionals can improve nearly every process in the field. As a data scientist in insurance, you need to practice the workflow cycle from managing and analyzing data to reporting and presenting insights to other team members.

Based on the ‘data scientist in insurance’ job descriptions we’ve looked into as research, these are the type of tasks your work might revolve around:

- Working with large datasets from different sources and performing exploratory statistics analysis.

- Working on developing robust statistical learning models.

- Using AI and machine learning techniques to design and build complex modeling solutions.

- Helping to define business problems and incorporating different data science techniques to solve them.

- Contributing to end-to-end solutions with data engineers.

Of course, this is not all you’ll be doing─like you’ve already learned, data science has many applications in insurance.

What Are the Required Skills to Become a Data Scientist in Insurance?

If you intend on working as a data scientist in this sector, then it’s going to take some extra steps to build an adequate knowledge base. We’ll now break down the skills you need to work with data science in insurance.

Domain Knowledge

Some people assume that you have to work in an insurance company or have previous experience in actuarial science but to simplify things, let’s first understand what that means.

Actuarial science is a science concerned with managing and assessing financial risks in the insurance sector where actuaries use mathematics and statistics to predict the probability of unexpected events in the future.

You can now guess that you need a solid foundation in actuarial science and you can do this easily with self-learning to fill in the gaps in your knowledge.

Programming Language Fluency

We all know that coding fluency is a standard to work in any data-related field. Since you’ll be dealing with data from different sources, it’s preferred to know more than one coding language.

Of course, you can start with Python which is quite easy to learn. When you have a strong grasp of the basics, you can check other languages such as R and Java. It’s also important to learn SQL to know how to manage, extract and store databases. The language is easy to learn, much like Python.

Remember, you don’t have to learn everything at once! Just take it step by step and make sure that you practice what you’ve learned.

Mathematics and Statistics

To break into data science in insurance, you need strong math and statistics abilities as most of the time you’ll probably be running statistical models. Moreover, you’ll also need them to analyze financial data and assess financial risks with probability analysis.

Machine Learning

There are many applications of machine learning in insurance (which we’ll elaborate on later). Therefore, you need to know a little bit about machine learning and specifically how to build predictive models to forecast future events─this is one of the main tasks a data scientist in insurance would do.

Soft Skills

Soft (or interpersonal) skills are probably the glue that holds your technical skills together. Knowing how to communicate your findings is as important as reaching them. Meanwhile, critical thinking and problem-solving contribute to your ability to resolve different business problems.

And while data visualization isn’t a soft skill, it’s still important to mention. Good visualizations will help you present your findings to the stakeholders in your insurance company in the most simple and appealing way.

Useful Resources

Data Science Courses

- Introduction to Python

This course will introduce you to the world of Python. You will learn about its technical advantages, specific features, modules, functionalities, and more. - Introduction to SQL

SQL is a must if you are expected to work with databases. This course is the ultimate guide, teaching you everything you need to know in terms of database management and creating SQL queries. - Introduction to Mathematics

This short course focuses on calculus and linear algebra so that you cover the basic foundations you’ll need to develop powerful algorithms. - Introduction to Statistics

This course begins with the very basics of statistics and builds up your arithmetic thinking. It gradually teaches you how to work with more complex analyses, statistical approaches, and hypotheses. - Machine Learning in Python

This course is focused on predictive modeling via an array of approaches such as linear regression, logistic regression, and cluster analysis. It combines comprehensive theory with lots of practice to allow you to exercise your Python skills.

Further Reading

- Actuarial Science

- What is Insurance?

- Analytics: The real-world use of big data in insurance

- Data Science in the Insurance Industry

- Top 10 Data Science Use Cases in Insurance

- Why Data Science is a Game Changer for Insurance Industry Today and Tomorrow

- The Need for Data and AI Skills in the Insurance Industry

- Data Analytics in Insurance Industry | The Ultimate Guide

How to Become a Data Scientist in Insurance: Next Steps

Now that you have a clear blueprint of data science in insurance, you can start right away with designing your study plan according to your time. You can start with an introduction to actuarial science and also test your current level in Python and SQL.

And as usual, we’re here to help you do that in the simplest way. From comprehensive introductions to Python and R to key considerations in machine learning, the 365 Data Science Program has everything you need to break into the field.

Under the guidance of leading industry experts, you will learn by doing with a myriad of practical exercises and real-world business cases. If you want to see how the training works, start with a selection of free lessons by signing up below.