Time Series Analysis with Python

$99.00

Lifetime access

What you get:

- 7 hours of content

- 64 Interactive exercises

- 40 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

$99.00

Lifetime access

What you get:

- 7 hours of content

- 64 Interactive exercises

- 40 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Employ proven time series techniques to make reliable forecasts

- Master the principles of manual model selection to select the most appropriate statistical models based on specific scenarios

- Be able to normalize data to compare and analyse different time series

- Apply key time series models in Python (AR, MA, ARMA, ARIMA, ARCH, GARCH) to predict credit risk

- Visualize important types of time series data such as white noise and random walk

- Secure a competitive edge over other candidates when applying for finance roles

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What does the Course Cover

4 min

2.1 Setting up the Environment

1 min

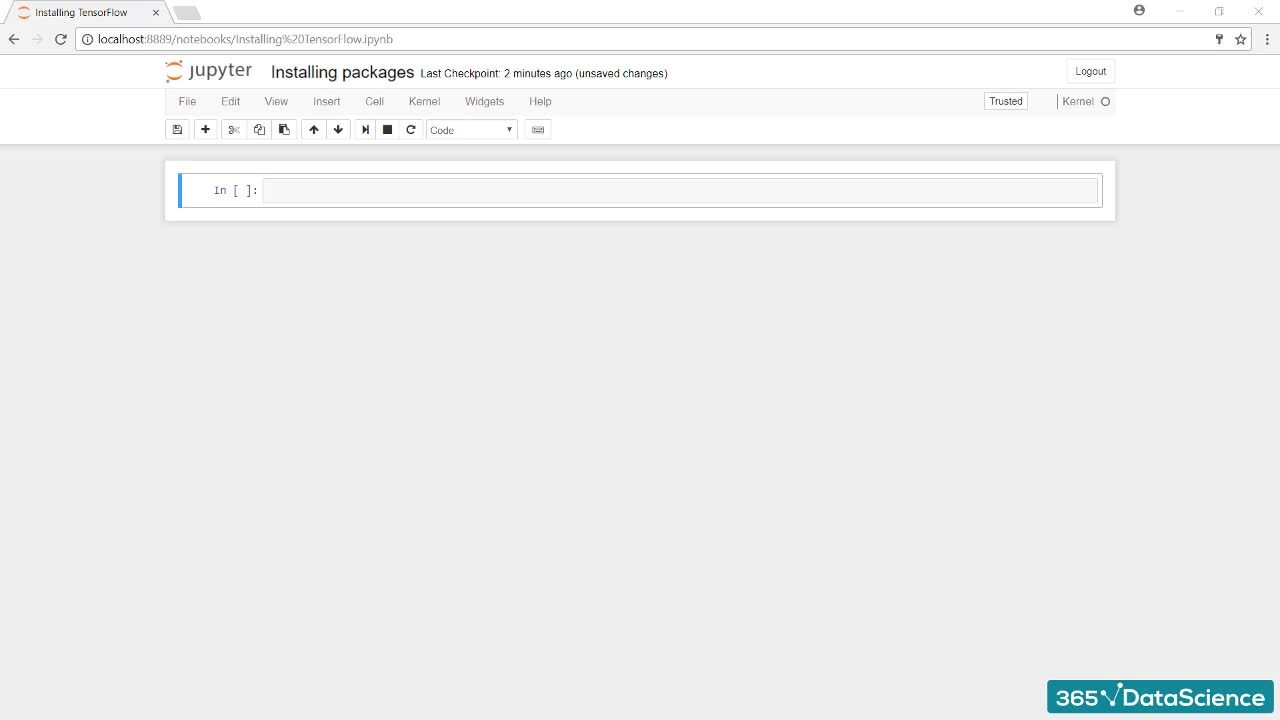

2.2 Installing the Necessary Packages

1 min

3.1 Introduction to Time Series Data

4 min

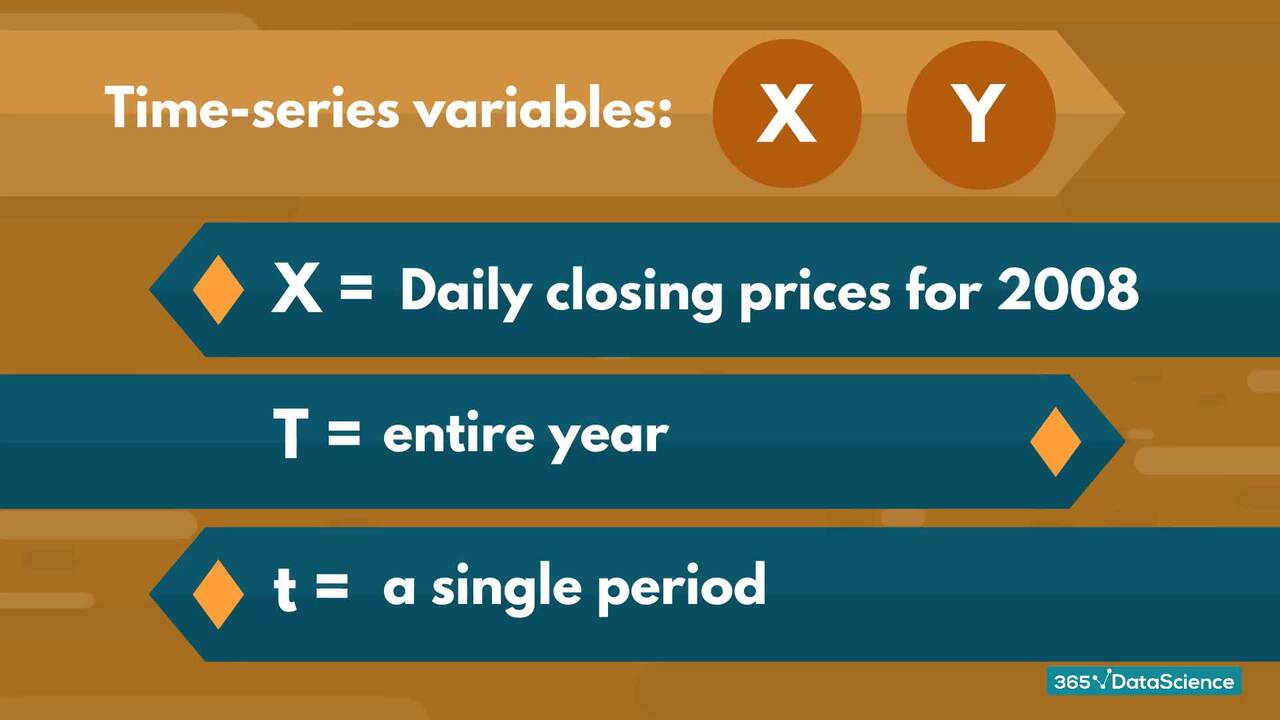

3.2 Notation for Time Series Data

1 min

3.3 Peculiarities of Time Series Data

3 min

Interactive Exercises

Practice what you've learned with coding tasks, flashcards, fill in the blanks, multiple choice, and other fun exercises.

Practice what you've learned with coding tasks, flashcards, fill in the blanks, multiple choice, and other fun exercises.

Curriculum

Topics

Course Requirements

- You need to complete an introduction to Python before taking this course

- Basic skills in statistics, probability, and linear algebra are required

- It is highly recommended to take the Machine Learning in Python course first

- You will need to install the Anaconda package, which includes Jupyter Notebook

Who Should Take This Course?

Level of difficulty: Intermediate

- Aspiring data scientists

- Current data scientists who are passionate about acquiring specialized knowledge

Exams and Certification

A 365 Data Science Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

A Hamilton College graduate, Viktor has a strong analytics background, focusing on the fields of Statistics, Econometrics, Financial Time-Series Econometrics, and Behavioral Economics. Viktor’s coding experience is rather diverse – from working with C, C++, and Python through to the more math/econ-oriented MATLAB and STATA. He has been fascinated by coding algorithms since the age of 11 and describes himself as a “Bachelor of Science and overall cool guy”. We couldn’t agree more. Some of Viktor’s personal achievements include developing a model for forecasting transfer prices of soccer players across Europe’s top divisions and Stock Market Indexes analysis on the effects of contagion on the effectiveness of international portfolio diversification.

What Our Learners Say

365 Data Science Is Featured at

Our top-rated courses are trusted by business worldwide.